GAP Insurance

What is GAP?

In the event of a vehicle being stolen and not recovered or in an accident and declared a total loss, few customers will receive a motor insurance pay out equivalent to the original purchase price from their motor insurer. GAP is important as vehicles depreciate overtime and average figures suggest that a 2-year-old vehicle would be worth about 65% of its original value, a 3-year-old vehicle 45% - 50% and for 4 years its value could drop to 35%-45% (these may vary depending on vehicle make and model). Your insurer will value your vehicle in line with the depreciation.

Gap insurance covers the difference between your insurance settlement at the point your vehicle is written off or declared a total loss and the purchase price of your vehicle when you bought it. The implications of having a total loss:

- You may still have a sizeable outstanding liability on your financing commitments

- You may have to make do with a lower specification replacement vehicle as the insurance settlement figure will be based on the value of vehicle on the date of your total loss

Here's an example

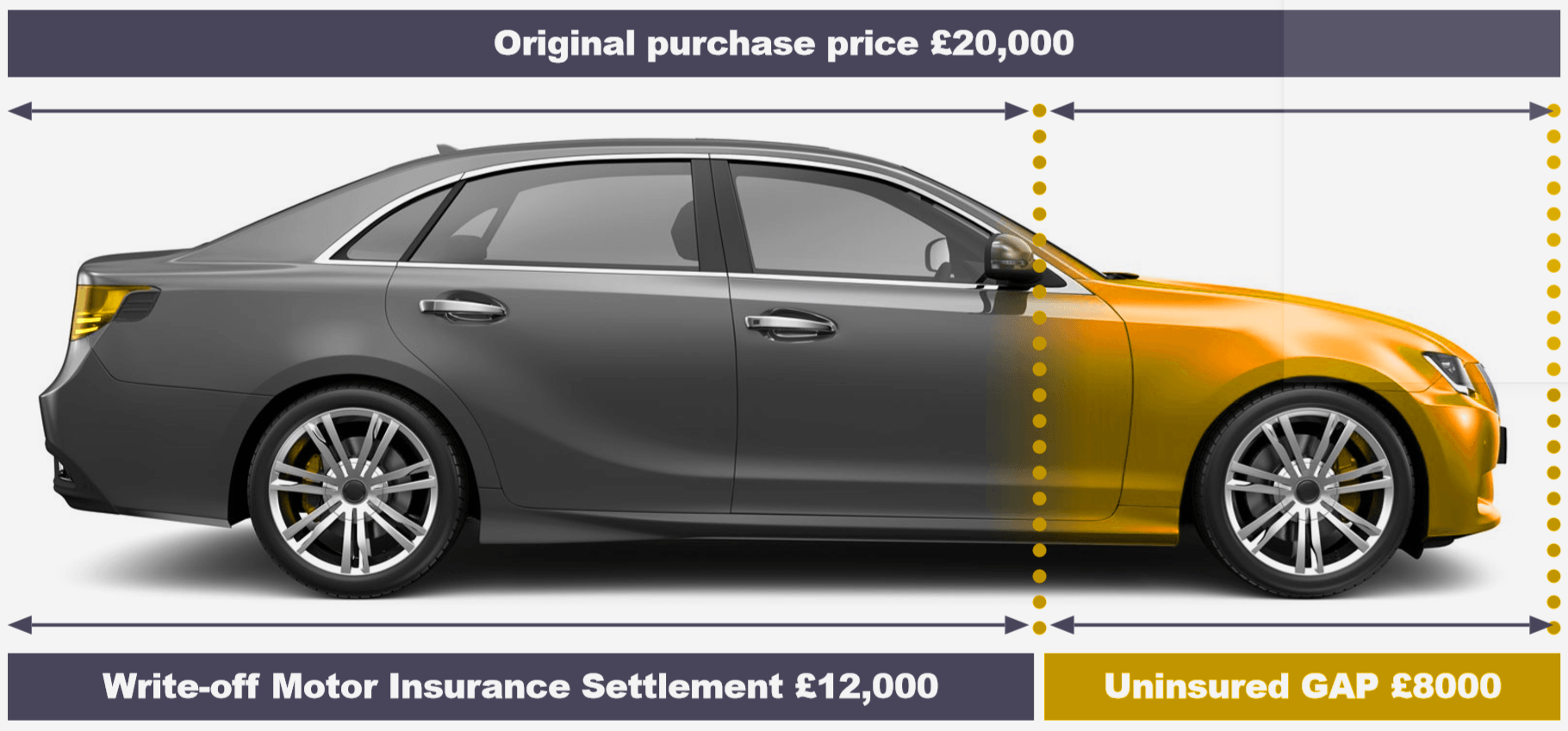

If your car is declared a total loss by your motor insurer, your insurer will offer you a final settlement based on the vehicle’s value on the day of the accident.

As we know there is likely to be a depreciation on your vehicle, therefore is it very unlikely to be the amount that you paid for the vehicle.

What are the different types of GAP?

Combined Return to Invoice GAP

Combined Return to Invoice Gap Insurance pays you the difference between the motor insurers 'Market Value' settlement the point of 'total loss' and the original invoice price you paid or the amount outstanding on finance whichever is the higher.

If you purchased your vehicle under a finance agreement and the outstanding finance balance at the point of total loss is greater than the original purchase price, RTI GAP insurance will pay the difference between the vehicle value at the point of total loss and the outstanding finance balance.

Cover will include up to a maximum of £250 motor insurance excess.

Cash Purchase Example:

Vehicle cost is £20,000 and your insurer pays out £12,000 then the GAP pays £8,000 so you get the full £20,000 back, subject to the cover selected.

Contract Hire & Lease

Contract Hire and Lease pays the difference between your motor insurers settlement and any outstanding rental/lease payments you may have. This policy is for you if you hire or lease a vehicle and you can take an option of covering any upfront lease or rental payments up to £3000.00.

In the event of your vehicle being declared a total loss then this policy will cover the outstanding contract hire settlement.

Example

Vehicle cost is £20,000 and your insurer pays out £15,000. You owe £18,000 to settle your contract hire/lease agreement so GAP pays out £3000 shortfall to settle the agreement, subject to the cover selected.